How Online Fraud Intelligence is Redefining Security In 2024

Outdated security methods leave businesses vulnerable to ever-evolving online fraud. Playing catch-up costsmoney and damages customer trust. But online fraud intelligence is revolutionising how we protect ourselves.

Let's explore how this cutting-edge technology is giving businesses the tools to fight back and win.

What is Online Fraud Intelligence?

Online fraud intelligence is a tool that uses data and advanced technology to safeguard your business from fraud. It goes beyond simply reacting to fraud after it happens by diligently collecting data on transactions, user behaviour, and device information.

Using AI and machine learning, it analyses these massive datasets to uncover patterns that often go unnoticed by humans. This allows it to spot potential fraud attempts before they cause damage to your business.

Simply put, you always stay one step ahead of criminals, protecting your finances, customer data, and your company's valuable reputation.

Why Online Fraud Intelligence is Important

Online fraud intelligence delivers a multi-pronged defence strategy, safeguarding your reputation, operations, and financial well-being. Here are some reasons why it’s important:

For Gaining Customer Trust

Today, with frequent data breaches, consumers are wary. They want reassurance that their financial information is safe before they'll open their wallets. And online fraud intelligence provides peace of mind in that regard.

When you proactively monitor transactions, devices, and user behaviour, you demonstrate your commitment to data security. That commitment turns into customer confidence, loyalty, and, ultimately, a stronger competitive advantage.

For Faster & Better Detection

Relying on manual reviews and outdated tools to spot fraud is a losing battle. Fraudsters constantly adapt, but intelligence systems keep pace.

These systems analyse massive amounts of data in real-time, pinpointing subtle red flags a human might miss.

AI-powered technology learns and evolves alongside fraud tactics, which means your defences remain tough. This speed and accuracy directly translate into stopping fraudulent transactions and neglecting the damage they can inflict.

For Preventing Losses

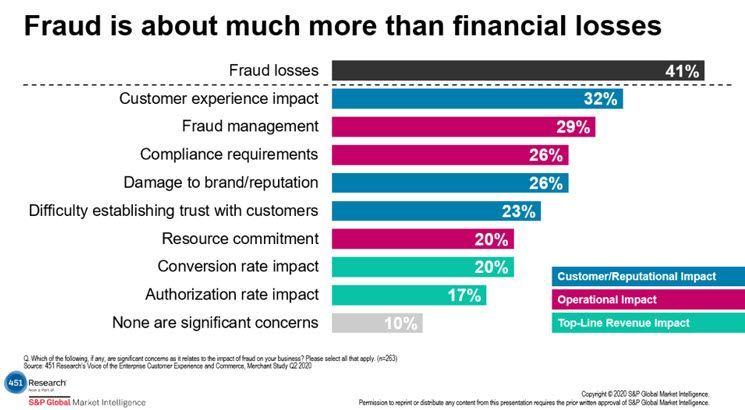

The direct financial cost of fraud is staggering. And loss is not just financial. There's a ripple effect

Online fraud intelligence tackles the ripple effects. Investigations, recovery, and potential fines consume valuable time and resources. Fraudulent chargebacks can damage relationships with payment processors.

So, protecting your bottom line isn't just about preventing initial losses; it's about minimising the expenses and disruptions that can derail your business.

How Exactly is Online Fraud Intelligence Reshaping Security?

Traditional security is like trying to play catch while wearing blinders. Here are some ways online fraud detection is reshaping the security for good:

Real-time Analysis

Every second counts when fraud strikes. Online fraud intelligence systems constantly analyse incoming data – transactions, customer behaviour, and device information. AI-powered algorithms detect suspicious patterns as they develop. This means immediate alerts rather than discovering fraud days or weeks later.

According to a recent study, businesses using real-time fraud detection tools reduced their fraud losses byan average of 40%. That means significant savings and reduced disruption.

Predictive Modelling

Online fraud intelligence is about anticipating the next move. Machine learning analyses historical data and learns the typical patterns associated with fraud. By combining this insight with real-time monitoring, the system can predict potential attacks before they even occur.

For example, predictive modelling has been crucial in combating "card-not-present" fraud, especially in e-commerce. When AI models analyse actors like shipping address mismatches and unusual spending patterns, they can flag high-risk transactions for review, saving merchants from costly chargebacks.

Cross-Industry Collaboration

Fraudsters don't operate in isolation. They target multiple businesses, refining their tactics along the way. Online fraud intelligence breaks these systems. Secure data-sharing platforms allow organisations across industries to pool their insights, creating a vast network of threat intelligence. That shared knowledge means a new scam identified by one company can quickly raise red flags for others.

Risk Scoring

Traditional security often relies on reacting to fraud after the damage is done. But risk scoring flips the script.

You can assign risk levels to transactions, users, and devices and ultimately, prioritise resources and efforts. High-risk scenarios receive immediate attention, while low-risk ones proceed smoothly.

For example, online fraud intelligence with risk scoring automatically flags suspicious purchases, such as someone using a new device in a different country. This allows for quicker action, like requesting verification or blocking the transaction.

Adaptability

Static rules and filters eventually become outdated as fraudsters adapt their tactics. Online fraud intelligence, through machine learning, can analyse historical data and adapt its models to recognise new patterns and emerging threats.

That continuous improvement ensures your security remains robust even as fraudsters change their approach.

For example, previously, security systems used basic rules like checking specific IP addresses for fraud, which fraudsters could bypass. Now, fraud intelligence analyses complex data patterns, uncovering hidden anomalies and suspicious behaviours.

Transparency for Trust

Traditional fraud systems can feel like a "black box." They spit out alerts without explaining why, making it hard to trust them completely. Online fraud intelligence, especially with white-box AI, changes this. It shows how it reached a decision, making you confident in its alerts. This openness is important for trusting the system and making good choices about possible fraud, which is also often required by law.

For instance, with a white-box system, you'd receive alerts for fraud, along with specific triggering factors (e.g., unusual amount, location mismatch), empowering informed decisions and potential security model adjustments.

Key Strategies Using Online Fraud Intelligence

Online fraud intelligence equips businesses with a robust toolkit for combating fraud. Here are some key strategies you can implement:

Use Real-Time Monitoring

To detect fraud as it happens, your fraud detection tool needs to work with your payment system. This lets it see transactions in real time. Tell the system what kind of fraud you're worried about, so it sends you the important alerts. Importantly, your team needs to know what the alerts mean and how to react quickly–blocking suspicious sales, contacting customers, or getting help if needed.

Implement Risk Scoring

Consider more than dollar thresholds for risk factors, including location differences, odd spending for new customers, and industry-specific red flags.

Map out responses for different risk levels. Low risk should pass smoothly, moate risk may need phone verification, and high risk should be blocked.

Fraud evolves, so analyse risk models regularly. Are they catching fraud? Flagging too many legit transactions? Adjust for the best results and a good customer experience.

Use Device Fingerprinting

Each device interacting with your platform leaves a unique combination of hardware, software, and behavioural data. Your online fraud Intelligence tool can use this "fingerprint" to identify repeat offenders.

If an incoming transaction matches a device profile known for previous fraud, this should be a major red flag. Proactively blocking these known malicious devices thwarts repeat attacks and lets you focus on identifying new threats.

Do Behaviour Analysis

Look at past customer behaviour to figure out what's "normal"—how much they buy, when they log in, and how they browse. Your fraud system should warn you if things look weird compared to these patterns.

Things like unusually big orders, logging in from a strange location, or odd ways of clicking around deserve a closer look. Remember, the system tells you what's odd, but you need to decide if it's actually fraud.

Protect Your Business Now with Cyberlutions®

The threat of online fraud looms large, but businesses don't stand defenceless. Online fraud intelligence redefines how we tackle this constant challenge. With proactive detection, intelligent risk assessment, and real-time response, these solutions are vital for any organisation that conducts business online.

So why wait for a painful wake-up call?

Cyberlutions® specialises in these cutting-edge solutions. We offer tailored systems, deep industry expertise, and a commitment to staying ahead of the ever-evolving threat landscape.

Contact us today to start building a more robust, resilient, and secure business.